The world of housing finance has just gotten a significant shake-up with the announcement that Fannie Mae, one of the largest mortgage financiers in the United States, has added a key Trump ally to its board. According to recent reports,

PulteGroup, one of the largest homebuilders in the country, has confirmed that Fannie Mae has appointed a new member to its board of directors. The new appointee is none other than

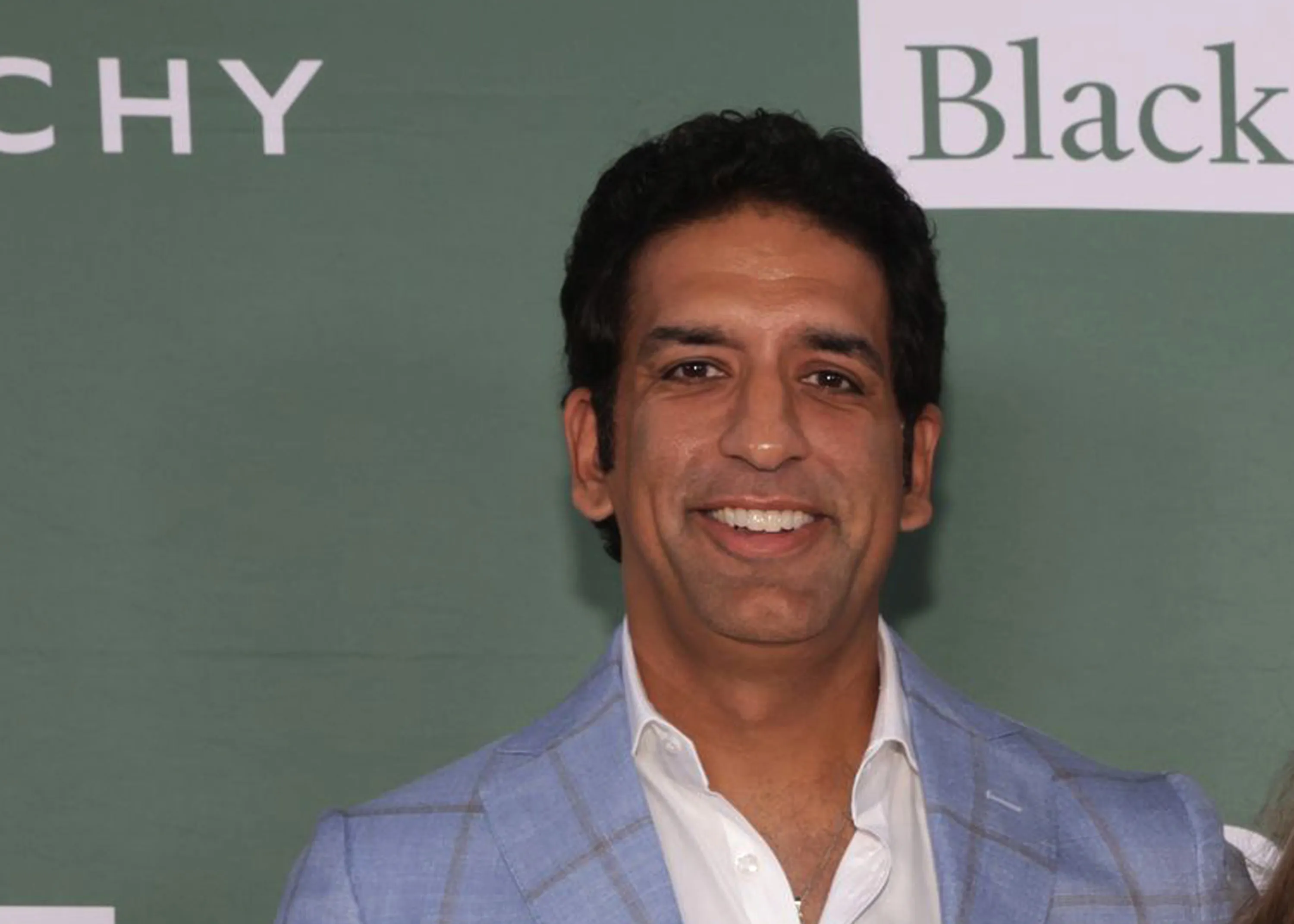

Ali Malik, a prominent businessman and ally of former President Donald Trump.

This move has sent shockwaves through the housing finance industry, with many analysts and experts weighing in on the potential implications of this new appointment. As a key player in the Trump administration, Malik's addition to the Fannie Mae board is seen by many as a strategic move to shape the future of housing finance in the United States.

Who is Ali Malik?

Ali Malik is a Pakistani-American businessman and entrepreneur who has been a long-time supporter of Donald Trump. He has been involved in various business ventures, including real estate development and investment. Malik has also been a vocal advocate for Trump's policies, particularly in the area of housing and finance. His appointment to the Fannie Mae board is seen as a significant coup for the Trump administration, which has been looking to exert its influence over the housing finance sector.

What does this mean for Fannie Mae?

The addition of Ali Malik to the Fannie Mae board is likely to have significant implications for the organization. As a key player in the Trump administration, Malik is expected to bring a pro-business and pro-development perspective to the board. This could lead to changes in Fannie Mae's policies and practices, potentially making it easier for homebuyers and developers to access financing.

However, some experts have raised concerns about the potential conflicts of interest that Malik's appointment may pose. As a businessman with ties to the Trump administration, there are questions about whether Malik's loyalty will lie with Fannie Mae or with the Trump administration. Additionally, some have raised concerns about the potential for Malik to use his position on the board to further his own business interests.

Reaction from the Industry

The news of Malik's appointment has been met with a mix of reactions from the housing finance industry. Some have welcomed the move, seeing it as a positive development that could lead to increased access to financing for homebuyers and developers. Others have expressed concerns about the potential implications of Malik's appointment, particularly with regards to conflicts of interest and the potential for undue influence from the Trump administration.

The appointment of Ali Malik to the Fannie Mae board is a significant development that is likely to have far-reaching implications for the housing finance industry. As a key ally of Donald Trump, Malik's addition to the board is seen as a strategic move to shape the future of housing finance in the United States. While some have welcomed the move, others have raised concerns about potential conflicts of interest and the potential for undue influence from the Trump administration. As the housing finance industry continues to evolve, it will be interesting to see how Malik's appointment plays out and what implications it may have for homebuyers, developers, and the industry as a whole.

Note: This article is for informational purposes only and should not be considered as investment advice. The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of Fannie Mae or any other organization.