Table of Contents

- Understanding the Australian tax system 2025

- Australia Income Tax Calculator 2025

- 2024 To 2025 Tax Brackets Australia - Coral Dierdre

- A Beginner's Guide to Understanding Australian Income Tax 2024 - YouTube

- Tax Brackets Australia 2024-24 - Karie Marleen

- Navigating the Australian Tax Brackets in 2024: A Comprehensive Guide

- Tax Rates 2024-24 Australia - Tildi Kelley

- Income Tax Rates Australia 2024 - 2024 Company Salaries

- Ato Tax Brackets 2024/25 - Elita Aurelie

- Australian Income Tax Rates 2024-25 - Rafa Ursola

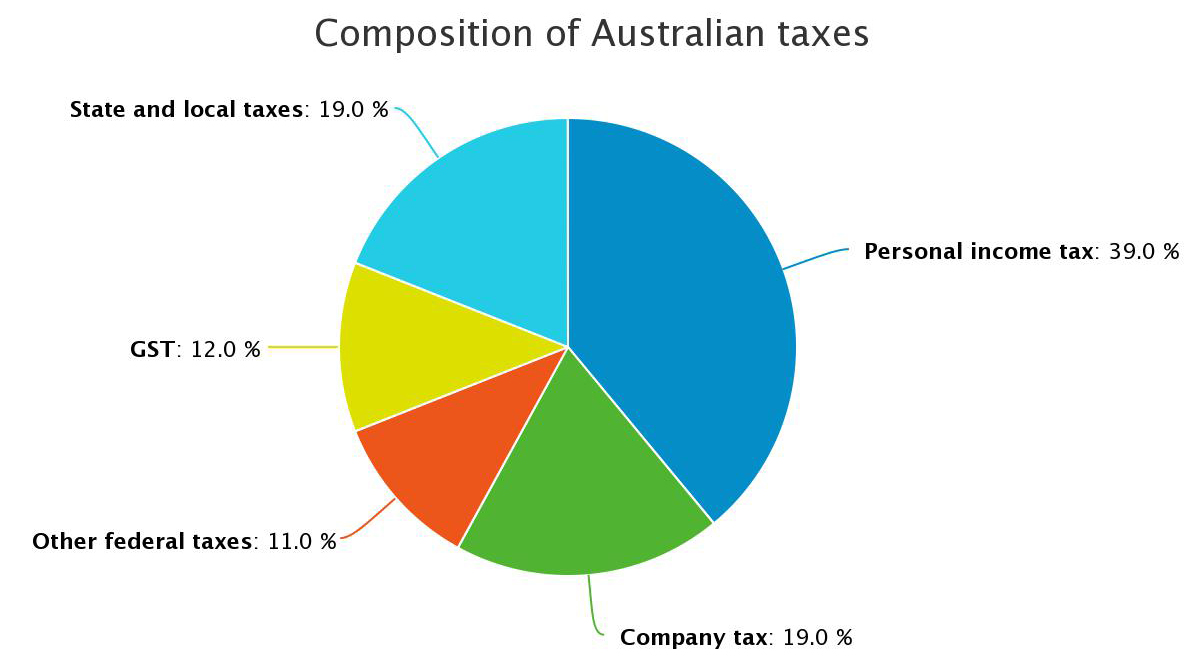

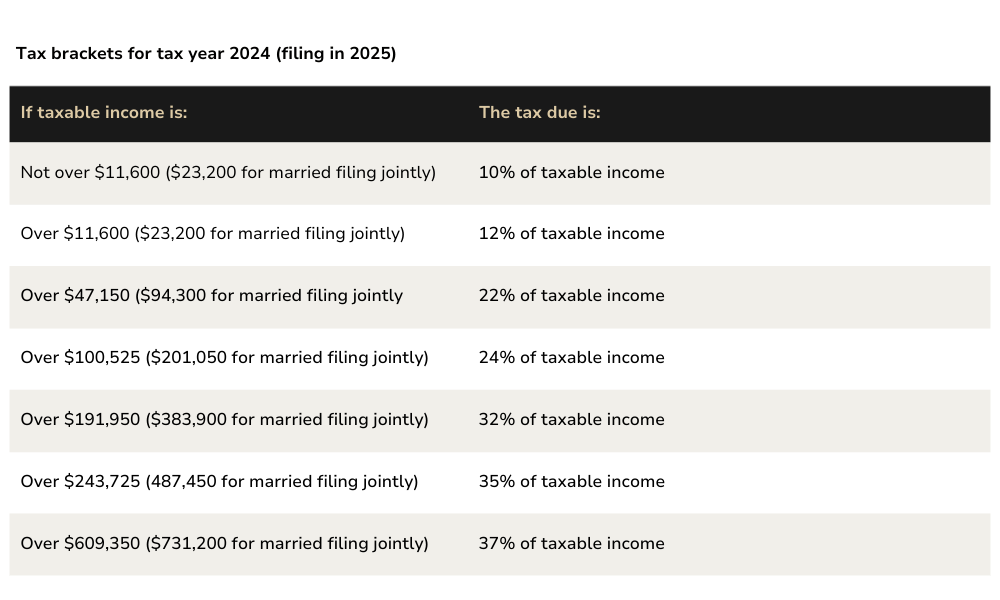

Current Income Tax Rates in Australia

Threshold Changes and Their Impact

Other Key Changes to Australian Income Tax

Several other changes have been made to the Australian income tax system in recent years, including: Removal of the 37% tax bracket: As of July 1, 2024, the 37% tax bracket will be abolished, and the 32.5% tax bracket will be extended to $120,000. Introduction of the Temporary Budget Repair Levy: Although this levy has since been repealed, it previously applied a 2% tax on incomes above $180,000. Changes to tax deductions and offsets: The government has introduced various changes to tax deductions and offsets, such as the instant asset write-off and the research and development tax incentive.

What Do These Changes Mean for You?

The changes to Australian income tax rates and thresholds can have a significant impact on your tax obligations. It's essential to understand how these changes affect your individual circumstances and to seek professional advice if needed. To ensure you're meeting your tax obligations and taking advantage of available tax offsets and deductions, consider the following: Review your tax return: Ensure you're claiming all eligible deductions and offsets. Seek professional advice: Consult a tax professional or accountant to ensure you're meeting your tax obligations and taking advantage of available tax savings. Stay informed: Keep up-to-date with the latest changes to Australian income tax rates and thresholds. By understanding the current state of individual income tax in Australia and staying informed about changes to rates and thresholds, you can ensure you're meeting your tax obligations and making the most of available tax savings. Remember to seek professional advice if you're unsure about how these changes affect your individual circumstances.Disclaimer: This article is for general information purposes only and should not be considered as tax advice. It's essential to consult a tax professional or accountant for personalized advice on your individual circumstances.